When the Andrews government delivered its bombshell last week, it has set off an enormous discussion across multiple platforms.

Will the Suburban Rail Loop (SRL) be automated? How big will the train fleet be? Is $50 billion too much to pay? What about other priorities for public transport? All those questions, and more, I’ve seen posed across all forms of media and internet platform. All of them relevant too.

One of my first thoughts was how much development will occur in station precincts. And more broadly, how might a property value uplift levy or some other form of tax reform in the stamp duty & land tax space help pay for the line?

It’s fundamentally the same question for Melbourne Metro 2. Infrastructure Victoria’s analysis of the preliminary costs and benefits show, if you view just the headline numbers, a poor outcome.

But that outcome comes with an asterisk which pointed out the value redeveloping Fishermans Bends’ over multiple decades was not taken into account because there were modeling limitations.

As noted in the limitations of this study, the land use impacts of major transport projects have not been assessed in this report. This is particularly relevant for Melbourne Metro 2 which will significantly enhance the accessibility of Fishermans Bend major urban renewal area and make the development more attractive. Urban consolidation facilitated by the Melbourne Metro 2 in the Fishermans Bend area will in turn contribute to increased agglomeration benefits arising from cluster effects as well as move to more productive jobs.

Urban Consolidation facilitated by Melbourne Metro 2 in the Fishermans Bend area will also lead to increased conventional benefits such as travel time and vehicle operating costs. These impacts have not been estimated in this report and could significantly underestimate the benefits associated with Melbourne Metro 2 and the urban consolidation facilitated by this project at the Fishermans Bend urban renewal area in particular.

KPMG, Arup, Jacobs – Preliminary demand modelling and economic appraisal for Infrastructure Victoria’s 30 year strategy, page 89 (link is external).

Unless much has changed since the consultant report was released in 2016, having the most robust business case – with a benefit-cost ratio as the ultimate output – will likely not be forthcoming for the SRL or MM2.

Therefore, I’ll add another question to the mix: is there a new model under development addressing the caveats in the Infrastructure Victoria 30-year strategy and supporting information?

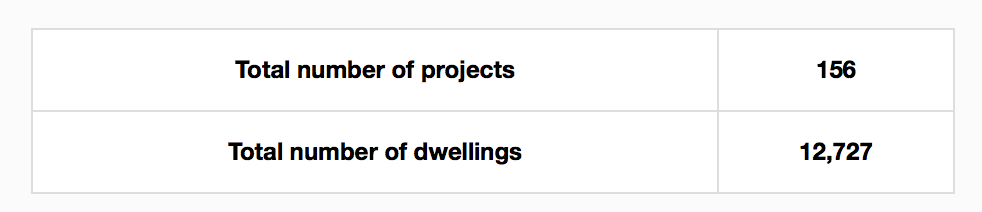

That said, it’s useful to take a good look at the current state of play throughout all the middle ring suburbs. 10% of all current projects on the Urban.com.au database for metropolitan Melbourne are in the suburbs that now have the SRL spotlight on them.

Here’s a summary on each suburb – click the suburb heading to see a lit of projects.

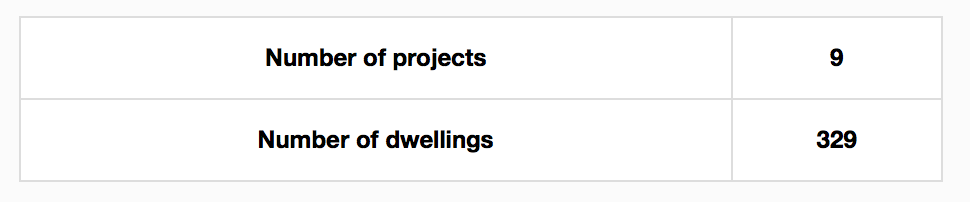

CHELTENHAM

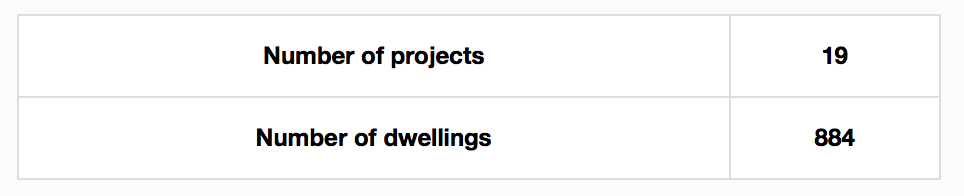

It’s not clear if Cheltenham or Southland will be the eastern terminus for the SRL, regardless, the suburb has a healthy supply of apartments in its own pipeline. The bulk are either sitting on the Urban.com.au database with a status of Planning Assessment or Approved and projects range from 15 apartments up to 126.

The majority of projects are concentrated in the Cheltenham and Southland station area.

CLAYTON-MONASH UNIVERSITY-MONASH NEIC

At the opposite end of the spectrum from Cheltenham, despite being the proposed ‘next stop’ on the SRL, Clayton’s pipeline is spread out, a lot. Likewise, the entire region which has the highest concentration of jobs outside central Melbourne already is getting a lot of love from the Victorian Planning Authority through its National Employment and Innovation Cluster framework.

The Monash NEIC is quite meaty and we’re likely to see increased development – commercial, institutional and residential – regardless. With the advent of the SRL however? I dare say: On your marks!

The database reflects the diverse land-uses in the area already with 3-4 institutional and commercial and hotel projects on the cards. Click here(link is external) for a refresher on VPA’s Monash NEIC framework plans.

GLEN WAVERLEY

It’s already a terminus station and one not shy of development with The Glen shopping centre seeing significant change, as well as residential components being added to it.

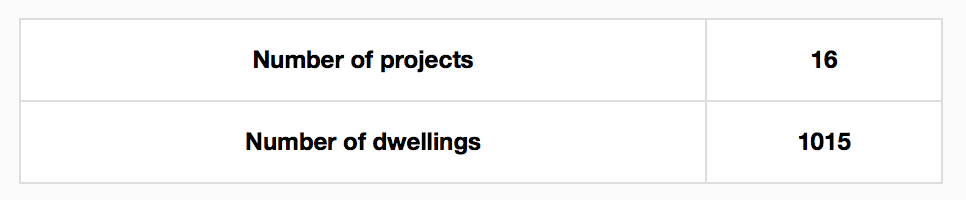

Where Cheltenham’s development size range has its upper end at 126, Glen Waverley is anything from 14 to 555. The development with 555 apartments is Golden Age’s multi-tower Sky Garden which is attached to The Glen shopping centre.

DEAKIN UNIVERSITY-BURWOOD

Excluding the University of Melbourne & RMIT, redbrick and ‘verdant’ universities in Melbourne were built in the automobile era and Deakin’s primary campus in Burwood – formerly Burwood teachers college – is linked by a radial tram route but relies on buses to the north and south.

Burwood has a decent spread of residential projects in its own right – one might suggest the tram line has something to do with it – but it also well-established suburb. It’s unlikely, to my layman’s eye, that there will be much redevelopment on the scale we might see around Monash or La Trobe universities.

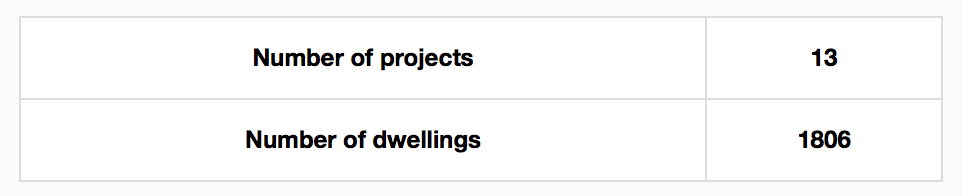

Burwood’s pipeline mostly lies in the residential growth zone which fronts the Burwood Highway (and tram route) with no project larger than 69 apartments.

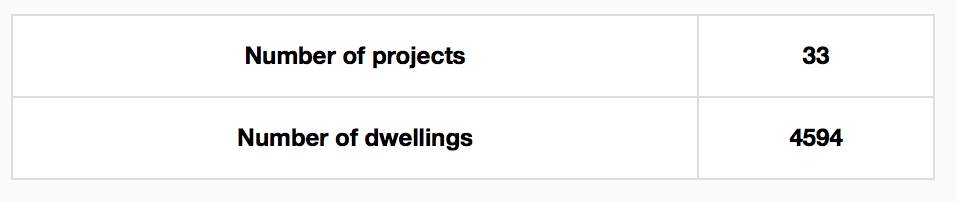

BOX HILL

Where Burwood is likely to see modest growth – unless something changes in the planning space between now and when (if) the SRL may be implemented – Box Hill as many readers will know is quite literally on fire with one of Melbourne’s most significant development pipelines.

Rather than give a summary, perhaps you might want to read a recent article on the suburb.

33 projects are in the pipeline for Box Hill with a range from 20 up to 500 – similar to Glen Waverley but on a much larger scale.

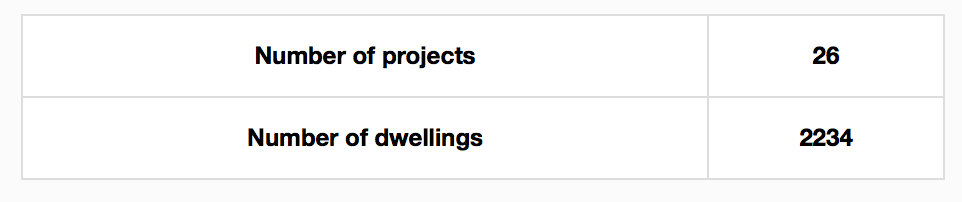

DONCASTER

No stranger to medium and high-density development, Doncaster and the wider City of Manningham, is the only local government area to have no rail service (tram or train). If the SRL is built, a significant amount of existing apartments that have been built around Doncaster Westfield and a very healthy pipeline of development will get access to rail service for the first time.

Doncaster like Box Hill and Glen Waverley have a good size range in the development pipeline and it is the second largest suburb in development pipeline numbers in this list of suburbs we’re looking at.

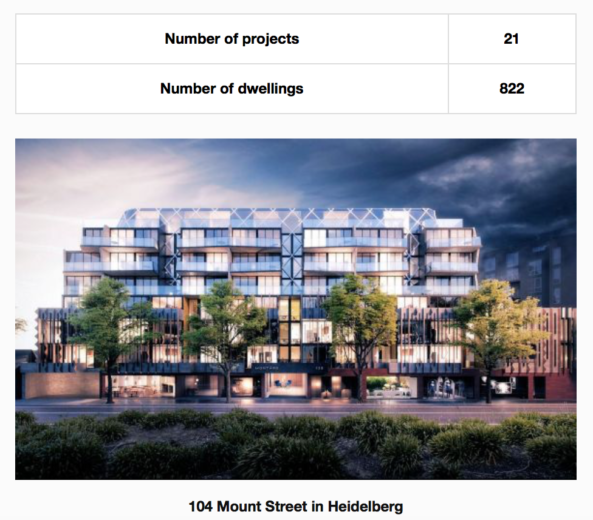

HEIDELBERG

Crossing the Yarra, Heidelberg like Box Hill has a significant amount of jobs located in its central area – especially in the health sector – and it too has a healthy pipeline of residential projects.

It’s a recurring theme among middle ring suburbs, much of the pipeline will disappear under the radar (unless you live in the area), Heidelberg, Cheltenham and Burwood are all characterised by developments with a size range of 15-120 dwellings.

Caydon’s Ivanhoe apartments was recently completed (and therefore is not a project and is not reflected in the below pipeline numbers) and there are other sizeable recently completed projects in the suburb as well.

Source From https://www.urban.com.au/transport/2018/09/03/whats-happening-in-the-suburbs-the-suburban-rail-loop-might-link