The RBA says it’s concerned about the risk to property developers as a result of tighter lending conditions.

In his speech, Assessing the Effects of Housing Lending Policy Measures, The Reserve Bank’s Deputy Governor Guy Debelle said the tightening in lending to developers seemed a higher risk to the economic outlook than the direct effect on households.

Speaking at a financial industry gathering, Debelle summarised the bank’s assessment of measures put in place to address risks around housing lending, reiterating the measures were aimed at the resilience of household balance sheets, not house prices.

“But at the same time, they clearly are having a notable effect on the housing market,” Debelle said.

The Effect on Developers

The Effect on Developers

While not directly related to the housing measures, Debelle said there had been some tightening in credit for developers of residential property.

“This reflects lenders’ reducing their desired exposure to dwelling construction, which is higher-risk lending, particularly given the longer planning and construction lags of higher density dwelling construction.

Banks are less willing to lend given the fall in prices, to the point where housing policy measures have contributed to the decline in investor demand and prices, which Debelle says have “indirectly affected developers’ access to finance”.

“There is a risk that this process overshoots leading to a sharper or more protracted decline in activity than we currently expect.

“The effect of a tightening in lending to developers seems to me to be a higher risk to the economic outlook than the direct effect of the tighter lending standards on households, which has ameliorated risk,” Debelle said.

Housing construction activity has been at a high level for some time now, he noted.

“Our forecast is for it to continue at this level for at least a year given the amount of work in the pipeline. Beyond that, we expect construction activity to decline from its peak.”

Off-the-plan apartment sales in east coast capital cities have declined since around mid-2017, with developers citing weaker demand from domestic investors, as well as from foreign buyers.

“One risk is that tighter lending standards could amplify the downturn in apartment markets if some buyers of off-the-plan apartments are unable to obtain finance,” Debelle said.

“This could lead to an increase in settlement failures, further price falls and even tighter financing conditions for developers. However, to date, in our liaison with developers, few have reported much evidence of this.”

The Rise of Small Lenders

The Rise of Small Lenders

Debelle said risky borrowing was more likely to accelerate an economic downturn, rather than become its trigger.

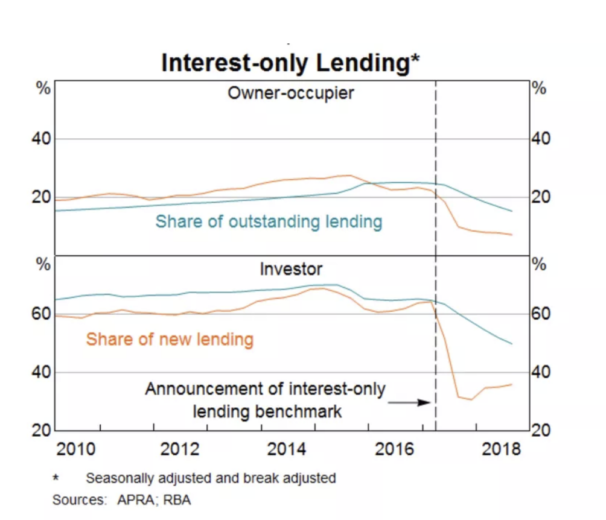

While the RBA has kept its cash rate unchanged at 1.5 per cent since August 2016, regulators have cracked down on riskier loans such as interest-only mortgages, typically popular with property investors.

“As a result of switching and weaker growth of investor lending, we estimate the share of housing loans to investors has declined by five percentage points to around one-third.”

Interest-only loans currently comprise 27 per cent of the stock, having been as much as 40 per cent.

The investor lending benchmark had a competitive impact for a time in that it constrained the ability of smaller lenders to gain market share by increasing their lending faster than 10 per cent.

Recently we have seen smaller lenders again gaining market share, Debelle said.

“Currently the major banks’ share of new lending is at its lowest in a decade.”

“The tighter lending standards have seen an increasing share of borrowers obtain finance from non-ADI lenders.”

“As a result, the estimated non-ADI share of housing credit has also increased, although it remains less than five per cent of the total.”

Resource from https://theurbandeveloper.com/