About

REA Insights Housing Market Indicators Report is a monthly report combining eight key metrics to provide an up-to-date view of the property market and emerging trends.

The report analyses consumer behaviour in real time by extracting property market insights from the millions of Australians who visit realestate.com.au each month.

Key metrics include search activity, email enquiry, views per listing, weekly sales of properties listed for sale on realestate.com.au, days on site of properties sold, filtered searches by price and by bedroom, and developer enquiry.

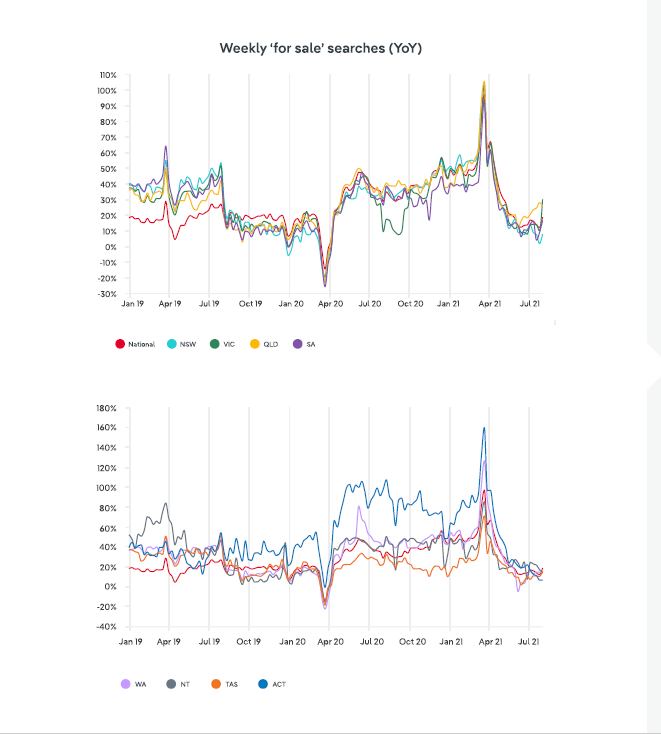

Recent lockdowns have given Australians moretime to search for properties

Last week, there was a 2.4% increase in national search volumes, which was the first rise in four weeks and the largest increase in 17 weeks. It seems that with more people locked down across the country it has led to an increase in property searches.

Each of the three states in lockdown during the week recorded an increase in search volumes with only WA and NT recording falls. At the end of last week, national search volumes were -8.7% lower than their peak in February 2021 with Qld the only state in which they were at an historic high.

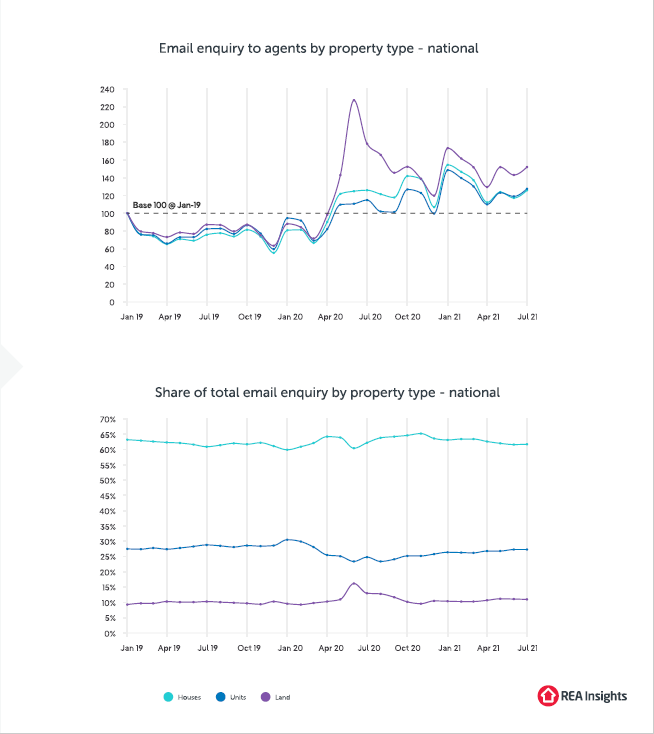

Email enquiry lifts as lockdowns extended

There was a 7.2% national increase in email enquiry to real estate agents on realestate.com.au in July, reaching its highest volume since March 2021. Enquiry was 0.9% higher year-on-year.

While search volumes to the buy section of realestate.com.au fell over the past month, enquiry lifted, likely due to lockdowns and people unable to physically inspect properties.

Houses (7.3%), units (7.2%) and vacant land (6.3%) each recorded a rise in enquiry over the month.

Houses remain the dominant type of property enquired about (61.7%) followed by units (27.3%) and then vacant land (11.0%).

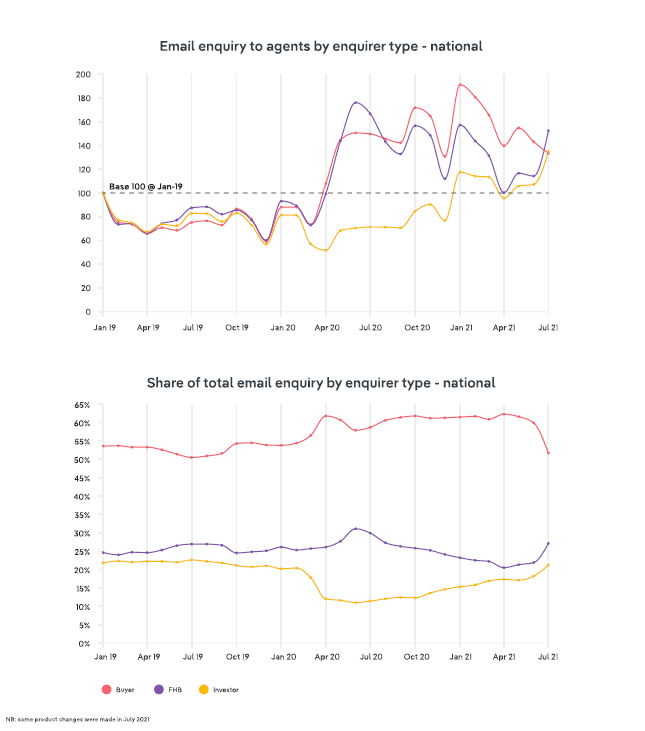

First home buyers and investors driving email enquiry surge

Although there was an overall rise in enquiry in July, buyer enquiry fell by -6.7% while enquiry from first home buyers (33.4%) and investors (26.0%) each recorded large jumps.

Investor enquiry is 89.0% higher year-on-year and the highest it has been since the beginning of 2019. First home buyer enquiry is -8.5% lower year-on-year, but the highest it’s been since January 2021. Enquiry from buyers was -10.9% lower year-on-year and the lowest it has been since December 2020.

First home buyer enquiry in July appears to be an anomaly and it is expected first home buyer demand will fall over the coming month. Buyer and investor demand is expected to lift.

Buyers continue to be the largest cohort of email enquiry at 51.7%, however, that share is the smallest since September

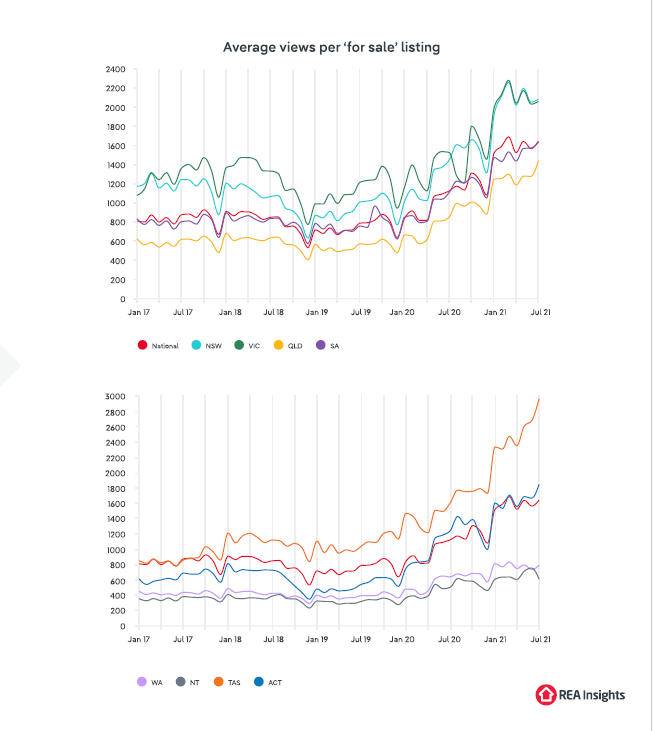

Views per listing rose as lockdowns reduced new supply of stock for sale

The number of views per listing on realestate.com.au for properties available for sale in July 2021 increased by 4.9% over the month to be 46.1% higher year-on-year.

New listing supply moderated due to lockdowns and with lockdowns extending into August, it is reasonable to expect a further tightening. Meanwhile, although search volumes have eased, they remain historically high, which in turn suggests that views per listing will remain at elevated levels over the coming months.

NT was the only state in which views per listing fell over the month, while across each state there has been a year-on-year increase in the metric.

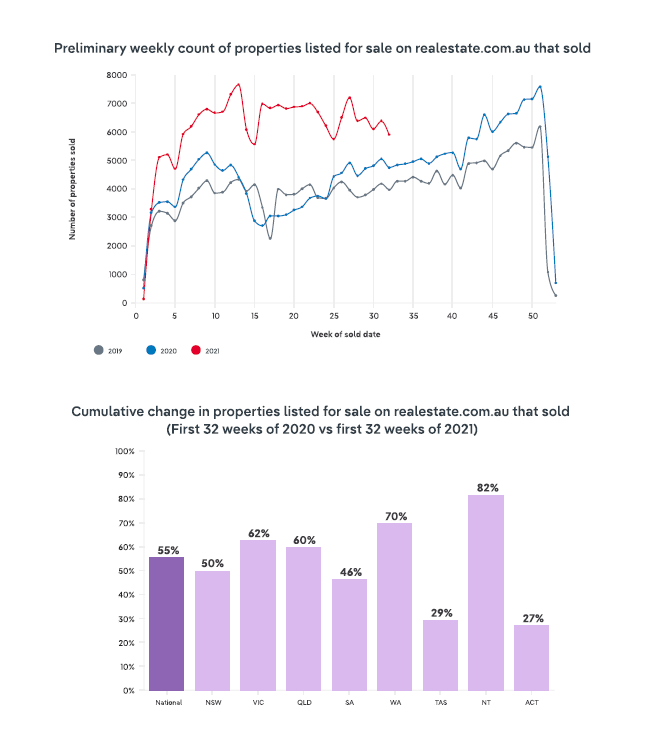

Weekly sales results weaken on the back of prolonged lockdowns

Preliminary sales volumes fell by -7.6% last week to be at their lowest level in seven weeks, as Australia’s three largest cities experienced lockdowns. Although weekly sales volumes were down, they were still 24.2% higher than over the same week last year.

With the recent weakness in preliminary sales volumes, last week they were -23.0% lower than their peak earlier this year in April. While sales have been declining recently, over the first 32 weeks of 2021, preliminary sales are 53.3% higher than over the same period in 2020, and 67.3% higher than the same period in 2019.

The implications of ongoing lockdowns across metro and regional areas in Australia are likely to result in a further weakening of sales. The coming months will be a test for the market’s resilience as even in those states not in lockdown, sales have slowed over recent weeks. Although this could be seasonal, the spring selling season will determine the market’s strength.

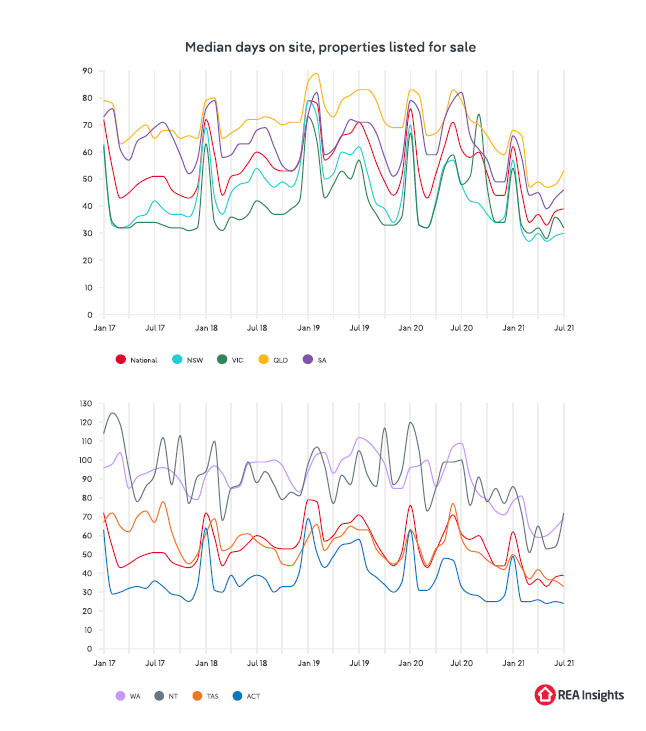

Median days on site rose for the second consecutive month

Of the properties that sold in July 2021, the median days on site was 39 days, which is slightly higher than the 38 days in June 2021, but much lower than the 61 days in July 2020.

Days on site fell over the month in Vic, Tas and ACT but rose elsewhere. Days on site in July 2021 was lower than in July 2020 across all states and territories.

For states with extended lockdowns, transacting on property remains difficult and will likely lead to increases in days on site. Elsewhere, the housing market continues to experience tight supply of stock for sale and strong demand, which should ensure days on site remain relatively low.

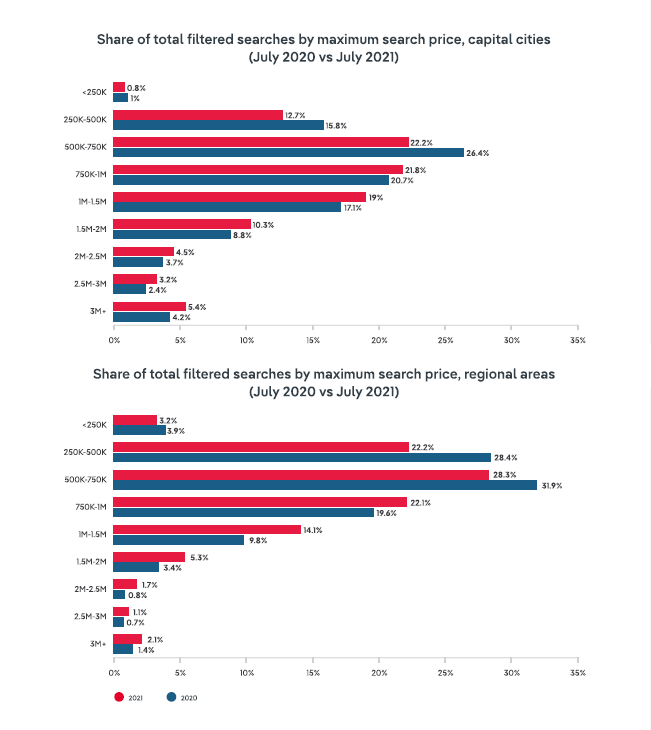

Increasing number of price filtered searches for properties priced at or above $1 million

Demand for properties remains strong and borrowing costs are low. Despite some signs of slowing price growth it would be reasonable to expect a further increase in higher priced searches over the coming months.

Throughout the combined capital cities, more than three times as many filtered price searches were for properties listed for at least $1 million (42.5%) than those less than $500,000 (13.5%) in July 2021. A year earlier, it was just over double the number of searches for $1 million plus properties (36.2%) compared to those available for less than $500,000 (16.8%).

In July 2020, 32.3% of price filtered searches in regional Australia were for properties available below $500,000 compared to 25.4% in July 2021. Conversely, 16.2% of searches in regional Australia a year ago were for properties priced at or above $1 million compared to 24.3% in July 2021.

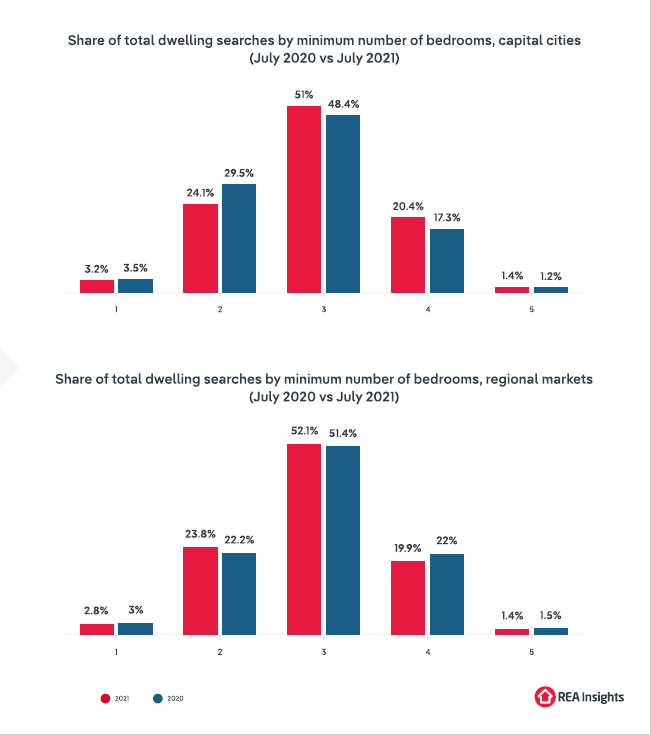

Most property seekers want at least three bedrooms

Across the capital cities, 33.0% of bedroom filtered searches in July 2021 were for one or two bedroom properties compared to 34.6% in July 2020. A different trend has been seen in regional markets with 27.3% of searches for fewer than three bedrooms this year compared to 25.1% a year ago.

We still see a smaller proportion of potential buyers in regional markets looking for one or two bedroom properties than we do in capital cities. However, the slight increase in the share of people searching for fewer than three bedrooms in regional markets over the past year probably reflects the shift in investor interest out of capital city apartment markets and into regional areas.

Space will continue to be an important factor for many buyers, despite price rises, and we expect demand for larger properties will likely remain substantial.

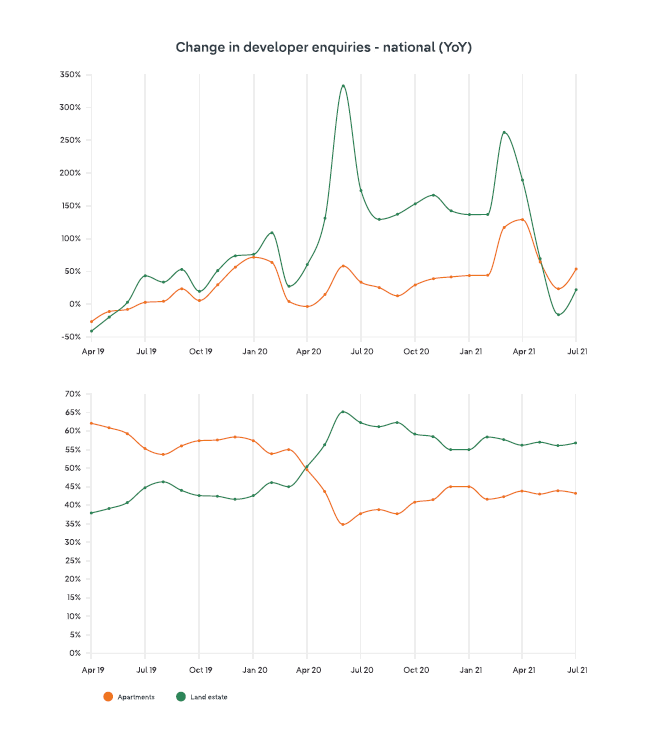

Developer enquiry lifted after three consecutive monthly falls

There was a 16.7% monthly increase in the number of enquiries to developers on realestate.com.au in July 2021, which was the first monthly increase in four months and the largest monthly increase since January 2021. Developer enquiries were 35.2% higher year-on-year in July 2021.

The number of projects advertised on realestate.com.au continued to fall in July, down by -0.7%, with the fewest active projects on site since October 2020. While enquiry rose substantially in July 2021, the supply of projects continued to fall.

In July 2021, enquiry for apartments rose 14.7% to be 53.8% higher year-on-year, while enquiry for land estates rose by 18.1% to be 22.2% higher year-on-year.

Developer enquiry was given a boost due to lockdowns across several states and the lack of new established housing listings coming onto the market. This may continue to be the case while lockdowns are in place, resulting in high volumes of enquiry expected to continue over the coming month.